Most successful business owners understand that if they really want to manage their business, they need to get comfortable with the fundamentals of bookkeeping and accounting. Many entrepreneurs who launch their own businesses start out by wearing the accountant’s hat and doing their own taxes,

in addition to doing just about everything else in the business, too. A lot of Entrepreneurs who handled bookkeeping and accounting usually discover they weren’t doing nearly as well on their own as they thought they were. Gapeseed offers recognized bookkeeping outsourcing services solutions that support end-to-end functions of bookkeeping services for Small Business & start-ups.

Some start-up incubators purport to go beyond office space and provide more diverse support services, such as bookkeeping and accounting, legal and management advice, and intellectual property assistance and is an essential part of “start-up India’ program recently launched by Indian Govt at Vigyan Bhawan in New Delhi. Ask any successful business owner or entrepreneur and they will tell you.

Cash (flow) is king

A healthy cash flow statement and a driven sales department are the life of any organisation. Your financial books can change from a positive to a negative balance, and your debt commitments, which were reasonable when you started, can rapidly become your worst nightmare.

Pro Tip: Debt should be used for generating more income (buying products on credit), and never to fund your lavish lifestyle. Outsource an authorized bookkeeper to handle your books.

Though in today’s world, it’s become easier for a layperson to keep track of a business’ finance with the advent of simple online bookkeeping services software’s, such as QuickBooks, Quicken, and Microsoft Office Small Business Accounting. But there comes a time in a growing enterprise when it makes sense to hand over responsibilities for taxes, accounting, and the rest of the financial functions to specialists.

Signs you need to outsource your bookkeeping services:

Maybe you want to better the financial function of your business.

Or perhaps your accounting software isn’t providing the type of data you need to grow your business. Having trouble switching from cash to accrual accounting?

Are your financial statements inaccurate or incomplete?

These are all good reasons to look for a qualified bookkeeping services firm.

Also, companies have seen cost savings of up to 40% by finance and accounting services outsourcing

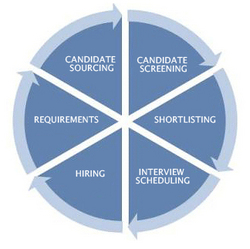

Before hiring a firm to fix your bookkeeping and accounting services do analyse firms.

Industry expertise – Previous experience in your industry makes things much easier for both the parties involved.

Size – Size and exact need of your requirement for a proper brief and guidance.

Complexity– Nature of service required from your firm.

With access to skilled resources available on a short notice, small business can venture in to larger business ventures by unlocking their liquid capital which is locked in hiring in house staff and paying company over heads in infrastructure investments. The right accounting and bookkeeping services firm can help a business with not only tax returns, but with longer term tax planning, business planning, networking, and even personal tax planning if your still the major stakeholder in your business

Duties and responsibilities usually include:

General ledger/chart of account maintenance

Responsibility for daily transactions

Financial statement preparation and analysis

Cost accounting and variance analysis

Treasury and cash management including bank reconciliations

Payroll and fixed asset accounting

Click to know detailed list of accounting & bookkeeping services provided by Gapeseed Consulting

Further to this if you seek any further clarity , feel free to write to us on, info@gapeseedconsulting.com or you can also call us at +91-9599444639.

More Newsletter

Outsource Bookkeeping Services and Simplify Taxation

Importance of Accounting for Startups

Gapeseed’s Accounting Services for Small Businesses