Gapeseed Facility & Management Services is a vertical of Gapeseed Consulting where in we provide HR solutions – right from staffing, recruitment, training and payroll management.

As we progress with our clients with their staffing & payroll processes – we constantly felt the need to explain the Social Security

Systems for effective Payroll Management.

The social security system in India is controlled by the government and applies to only a small portion of the popular.

The social security system includes not just an insurance payment of premiums into government funds, but also lump sum employer obligations. It is significant to understand the Social Security Systems for effective Payroll Management.

Generally, India’s social security schemes cover the following types of social insurances:

PENSION

The Employees’ Provident Funds & Miscellaneous Provisions Act, 1952 (EPF & MP Act) which applies to specific scheduled factories and establishments employing 20 or more employees and ensures terminal benefits to provident fund, superannuation pension, and family pension in case of death during service. Separate laws exist for similar benefits for the workers in the coal mines and tea plantations.

HEALTH INSURANCE AND MEDICAL

The Employees’ State Insurance Act, 1948 (ESI Act) which covers factories and establishments with 10 or more employees and provides for comprehensive medical care to the employees and their families as well as cash benefits during sickness and maternity, and monthly payments in case of death or disablement.

MATERNITY

The Maternity Benefit Act, 1961 (M.B. Act), which provides for 12 weeks wages during maternity as well as paid leave in certain other related contingencies.

GRATUITY

The Payment of Gratuity Act, 1972 (P.G. Act), which provides 15 days wages for each year of service to employees who have worked for five years or more in establishments having a minimum of 10 workers.

DISABILITY

The Employees’ Compensation Act, 1923 (WC Act), which requires payment of compensation to the workman or his family in cases of employment related injuries resulting in death or disability.

The payroll management system differs at different levels depending upon the industry, the type of business entity, the state rules & regulations which applicable to the company etc. Here are the details on the following Social Insurances as applicable in the Payroll Management Systems of almost all large corporate houses.

PENSION

The Employees’ Provident Fund Organization, under the Ministry of Labor and Employment, ensures superannuation pension and family pension in case of death during service. Presently only about 35 million out of a labor force of 400 million have access to formal social security in the form of old-age income protection. Out of these 35 million, 26 million workers are members of the Employees’ Provident Fund Organization, which comprises private sector workers, civil servants, military personnel and employees of State Public Sector Undertakings.

The schemes under the Employees’ Provident Fund Organization apply to businesses with at least 20 employees. Contributions to the Employees’ Provident Fund Scheme are obligatory for both the employer and the employee when the employee is earning up to INR 6,500 per month and voluntary when the employee earns more than this amount.

If the pay of any employee exceeds this amount, the contribution payable by the employer will be limited to the amount payable on the first INR 6,500 only. Contributions should be made to the Employees’ Provident Fund Organization on an annual basis. The Employees’ Provident Fund Organization includes three schemes:

The Employees’ Provident Fund Scheme, 1952

The Employees’ Pension Scheme, 1995

The Employees’ Deposit Linked Insurance Scheme, 1976

- The Employees’ Provident Fund Scheme is contributed to by the employer (1.67-3.67 percent) and the employee (10-12 percent).

- The Employee Pension Scheme is contributed to by the employer (8.33 percent) and the government (1.16 percent), but not the employee.

- • Finally, the Employees’ Deposit Linked Insurance Scheme is contributed to by the employer (0.5 percent) only.

Four main types of pension (all monthly) are offered:

- Pension upon superannuation or disability;

- Widows’ pension for death while in service;

- Children’s pension; and

- Orphan’s pension.

In addition, there are separate pension funds for civil servants, workers employed in coal mines and tea plantations in the State of Assam, and for seamen.

HEALTH INSURANCE AND MEDICAL

India has a national health service, but this does not include free medical care for the whole population. The Employees’ State Insurance Act creates a fund to provide medical care to the employees and their families, as well as cash benefits during sickness and maternity and monthly payments in case of death or disablement for those working in factories and establishments with 10 or more employees.

In case of sick leave, the employer will pay half salary to the employees covered under the Employee’s State Insurance Act.

DISABILITY

The Workmen’s Compensation Act requires the employer to pay compensation to employees or their families in cases of employment related injuries resulting in death or disability.

In addition, workers employed in certain types of occupations are exposed to the risk of contracting certain diseases, which are peculiar and inherent to those occupations. A worker contracting an occupational disease is deemed to have suffered an accident out of and in the course of employment and the employer is liable to pay compensation for the same. Occupational diseases have been defined in the Workmen Compensation Act in parts A, B and C of Schedule III.

Compensation calculation depends on the situation of occupational disability:

a. Death: 50% of the monthly wage multiplied by the relevant factor (age) or an amount of INR 80,000/- whichever is more.

b. Total permanent disablement: 60% of the monthly wage multiplied by the relevant factor (age) or an amount of INR 90,000/- whichever is more.

c. The Compensation Act also includes stipulations for partial permanent disablement and temporary disablement (total or partial).

GRATUITY

For establishments with ten or more employees, the Payment of Gratuity Act requires the payment of 15 days of additional wages for each year of service to employees who have worked at a company for five years or more.

MATERNITY

The Maternity Benefit Act requires an employer to offer 12 weeks wages during maternity as well as paid leave in certain other connected contingencies.

Every woman shall be entitled to, and her employer shall be liable for, the payment of maternity benefit at the rate of the average daily wage (the average of the woman’s wages payable to her for the days on which she has worked during the period of three calendar months immediately preceding the date from which she is absent on account of maternity), including the day of her delivery and for the six weeks immediately following that day.

The maximum period for which any woman shall be entitled to maternity benefit shall be 12 weeks, six weeks up to and including the day of her delivery, and six weeks immediately following that day.

During the one month proceeding the period of six weeks before her expected delivery or any period during that six week period for which she does not take a leave of absence, no pregnant woman shall be required by her employer to do any work that is arduous, involves long hours of standing or is in any way likely to interfere with her pregnancy or otherwise adversely affect her health.

Any woman working in an organization and allowed to maternity benefit may give written notice to her employer stating that her maternity benefit and any other benefits to which she may be entitled may be paid to her or to anyone she nominates in the notice, and that she will not work in any establishment during the period for which she receives maternity benefit.

On receipt of the notice, the company shall authorize the employee to absent herself from the company until the end of six week period following the day of her delivery.

The maternity benefit for the period preceding the date of her expected delivery shall be paid in advance by the company to the employee after having confirmed that she is pregnant. The amount due for the subsequent period shall be paid by the employer to the employee within 48 hours of the child’s birth.

In addition to the above, the act states that no company shall deliberately employ a woman in any organization during the six weeks immediately following the day of her delivery or her miscarriage. No company shall compel its female employees to do tasks of a laborious nature or tasks that involve long hours of standing or which in any way are likely to interfere with her pregnancy or the normal development of the foetus, or are likely to cause her miscarriage or otherwise adversely affect her health.

It is very important to understand the Social Security Systems for Effective Payroll Management. The latter should be developed keeping in consideration the former.

Payroll Management Systems are also significant for SMEs and Small Business for transparent and influencing Employer Branding. For better understanding on our Payroll Services, you can download the Free Guide to Payroll Management.

Get in touch with us now at info@gapeseedconsulting.com or call up: +91-9599444630/9 to know more.

More Newsletters

PAYROLL ACCOUTING

8 TIPS TO RETAIN THE BEST OF YOUR EMPLOYEES

Payroll Services for Startups

Benefits for HR and Payroll Software

7 Qualities for Recruitment Process Outsourcing

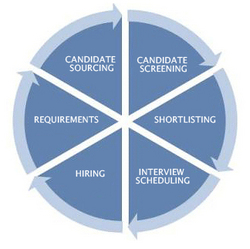

Recruitment Process Outsourcing Services

Payroll Services in Delhi NCR