Our love for startups is forever increasing. And with our experience of working with them, we have realized that, Startups are natural rule breakers you got to come out of that comfort zone if you want to be the next big thing in the industry.

But there is one area where you wouldn’t want to mess around with the rules and that is payroll and HR. To avoid any legal and financial litigation you must comply with payroll and HR laws. Some of your actions might drive you out of the business as well. Keeping this in mind we offer Payroll services.

Like other business strategy and planning, payroll services for startups need to be taken seriously and keeping our client in mind the following are the important consideration on the basis of which we provide our services.

1. Convenience

Payroll services for Startups should not be a problem. It should be a cake walk that’s easy to do and one that can be done on any computer or mobile device. To achieve these tasks we make sure that our clients aren’t confined to their office or required to phone in hours manually every time they want to run payroll. Having the ability and the technology to run payroll from anywhere in fraction of minutes is something that we focus on to provide our services to our clients.

stration and will also manage it for you with the shared admin rights so that you can keep a tap on how Gapeseed Consulting is managing the Payroll Services for Startups.

2. Set Up

Gone are the days of paper-based payroll system, move on to a more advanced paperless system it would not require an immense learning from your side or big task, time-consuming training sessions. The transition should be smooth, quick, and easy. The software should be simple, straightforward, and well, user friendly to use.

We will provide you the demonstration and will also manage it for you with the shared admin rights so that you can keep a tap on how Gapeseed Consulting is managing the Payroll Services for Startups.

3. Cost Advantage

For many small business owners, cost cutting is a major thing, the payroll services they choose is often based on one thing – cost. But, when they get their monthly invoice, the amount owed can be significantly more than what they expected to pay. Unfortunately, hidden fees are common in this industry, but luckily not all providers “follow the rules.” A payroll provider’s services and pricing structure should be completely transparent so you know exactly what your invoice is going to be based on how many employees you have and the services you select and we assure you to give a transparent service. As we understand that Payroll Services for Startups are managed as they are having small teams and optimism resources.

4. Service Options

Many a times payroll providers just offer few payroll services, where as we offer a whole host of services designed so as to make your job easier. These services include

- Payroll Accounting,

- Attendance Register (Controls),

- Online employee access to payment records,

- Direct deposit,

- Wage garnishments,

- Easy CTC calculations,

- Compliances,

- Manage Employee Information Efficiently,

- Define the emoluments, deductions, leave etc.,

Other Payroll Services for Startups include, Generate Pay-Slip at the convenience of a click, Generate and Manage the Payroll Processes according to the Salary Structure assigned to the employee, Generate all the Reports related to employee, attendance/leave, payroll etc., Manage your own Security.

5. Partners & Integration

You have to stay away from payroll providers who are not willing to partner and integrate with other HR and accounting systems. When a payroll system is easily matched with other types of accounting services, you own a great flexibility, more control, and better results. Similarly, it is important for us to understand small business needs in order to provide the most complete payroll package possible.

In order to achieve these goals, the government has simplified the business registration process as well as the rules that govern the process. Now, entrepreneurs can start a company in India easily. Even, simple licensing application can be done through self-certification or third part certification system. With the integrated online portal and less paperwork system, entrepreneurs do not have to worry about the administration burden and are able to focus more on running the companies. With initiatives like Make in India, Startups have ocean of opportunity and with such a situation Gapeseed Consulting can be a perfect choice for your business to outsource the payroll services.

To know more about the Payroll Services at Gapeseed Consulting, please connect or write to info@gapeseedconsulting.com

More Newsletters

8 TIPS TO RETAIN THE BEST OF YOUR EMPLOYEES

Benefits for HR and Payroll Software

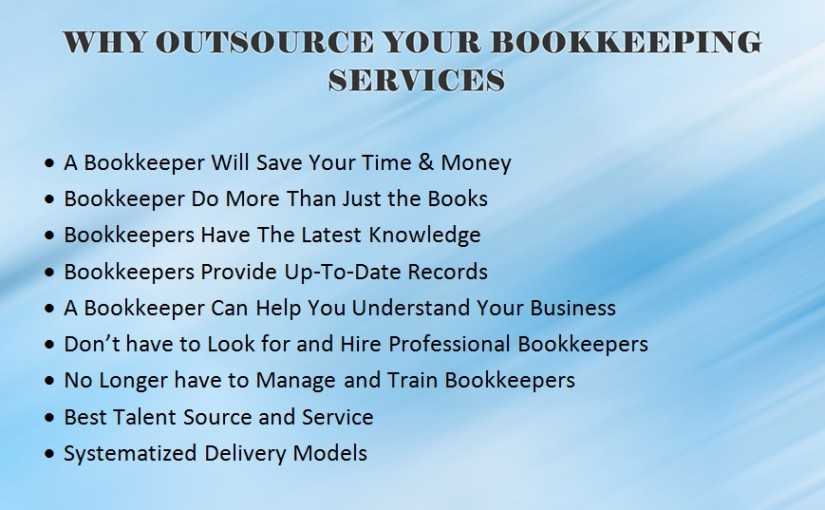

Gapeseed’s Accounting Services for Small Businesses

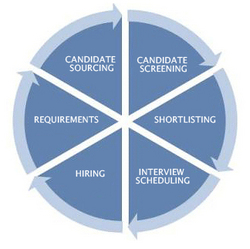

7 Qualities for Recruitment Process Outsourcing